I'm a Mortgage Brokera Grampaa baseball nuta dog lovera Dad and a Husband

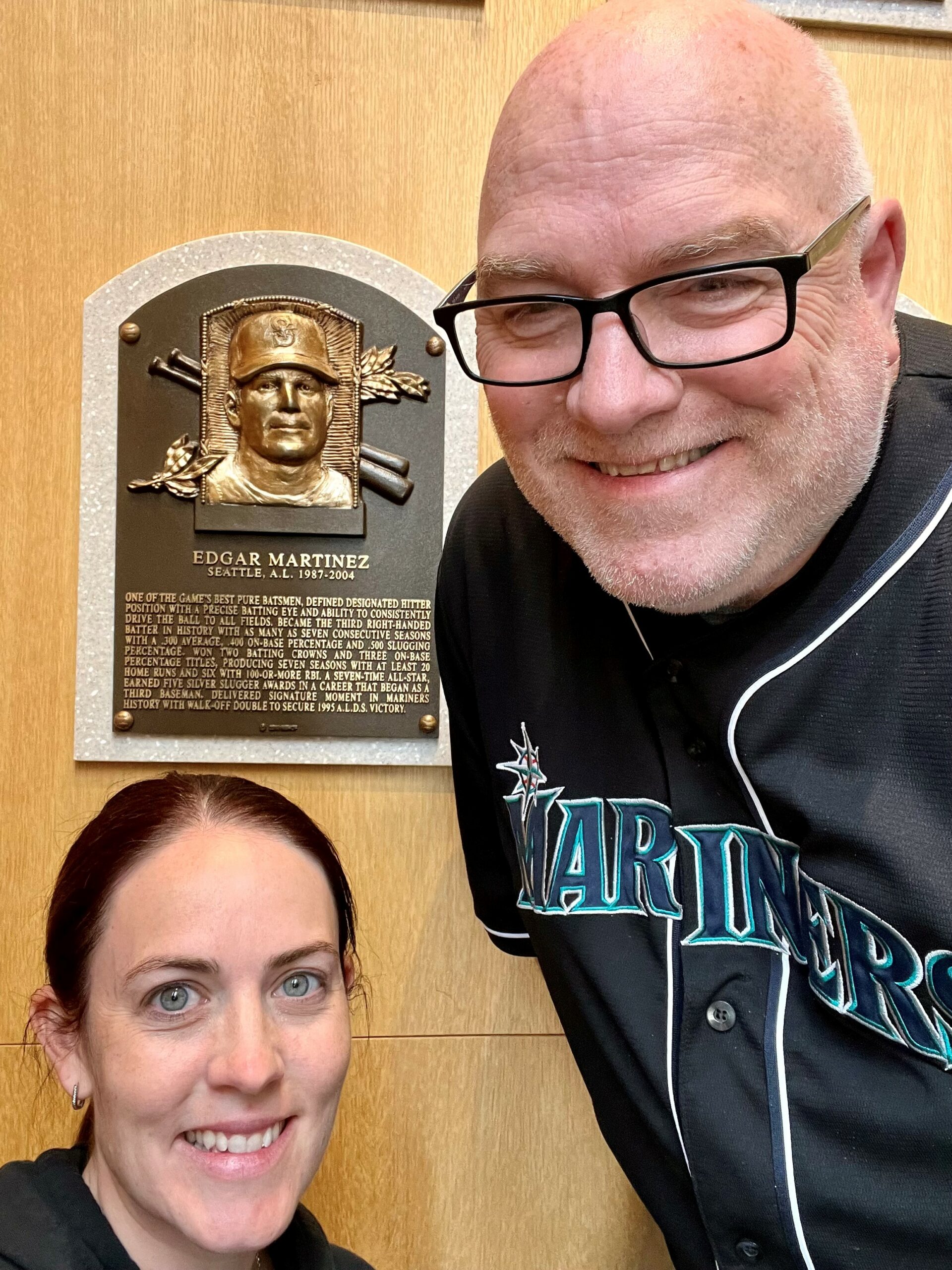

With more than 8 years of experience in the mortgage industry, I am excited to join Advantage Mortgage as a dedicated Mortgage Advisor. Based in the picturesque Wenatchee Valley, I am licensed to serve clients in both Washington and Oregon. My approach to the loan transaction process is centered around transparency and client education. I believe that clients should be fully informed and educated about all their options, so that they can have confidence that their decisions are what’s best for them. I always provide recommendations as if I were in their shoes. Sometimes this even means not doing a loan right away! This client-first philosophy ensures that every decision is made with the client’s best interests in mind. Outside of my professional life, I am a passionate Seattle Mariners fan and love spending time outdoors with my family. Whether it's fishing, camping, off-roading, or enjoying the natural beauty of the Wenatchee Valley, these activities enrich my life and keep me grounded. I am committed to bringing the same enthusiasm and dedication to my work at Advantage Mortgage, helping clients navigate the mortgage process with confidence and ease. Call me today!

Bill Berman – Certified Mortgage AdvisorTM

One of only 20 CMA’s in Washington State!

First Time Home Buyers

As a CMA and Mortgage Advisor dedicated to serving first-time homebuyers, I am deeply committed to providing more than just a loan. Through my tailored classes and emphasis on client education, I equip individuals embarking on their homeownership journey with the knowledge and tools necessary to make informed decisions that will shape their financial future. By focusing not only on securing a mortgage but also on building generational wealth, I empower clients to see homeownership as a steppingstone towards a more prosperous future for themselves and their families. With a keen understanding of the importance of wealth accumulation, I guide first-time buyers towards strategic financial decisions that will lay the groundwork for long-term stability and success.

VA Loans

I’m the dad of a combat Vet, and as a Mortgage Advisor committed to serving veterans, I am dedicated to ensuring that those who have served our country have access to the benefits they deserve through VA loans. Through specialized classes tailored to veterans, I provide comprehensive education on VA loan eligibility, benefits, and the homebuying process. My focus on client education extends beyond just securing a loan; I strive to empower veterans with the knowledge they need to build wealth through homeownership. By leveraging VA loan benefits such as no down payment and competitive interest rates, I help veterans achieve their dreams of homeownership while also setting them on a path towards long-term financial stability and wealth accumulation. It’s an honor to support those who have served our nation and to guide them towards a brighter financial future.

Where are you in your journey ?

I understand that no two clients are alike, so I put together useful mortgage information specific to different homebuyer and homeowner situations.

How to Apply for a Mortgage Home Loan

Step 1: Complete Your Mortgage Loan Application

Start by filling out the Mortgage Loan Application, where you’ll provide your personal and financial details for our review. Be sure to upload all necessary documents—this helps us assess your information and provide an accurate Pre-Approval.

Step 2: Request Your Credit Report

Next, you’ll need to request and pay for your credit report. This report allows you to review your credit details for accuracy, access your credit scores, and submit them for the Pre-Approval process.

Cost: $96 (paid directly to the credit bureaus)

[Order Your Credit Report Here]

Step 3: Consultation & Pre-Approval Discussion

Once we’ve reviewed your application and credit report, we’ll schedule a consultation to discuss:

Your approved loan amount

Estimated monthly payments

The home-buying process

Any questions you may have

Prefer to apply in person? Give me a call, and we’ll set up a time!

FREQUENTLY ASKED QUESTIONS

What is a

Pre-Approval?

A pre-approval is a preliminary assessment of how much you may qualify to borrow, including your estimated loan amount, interest rate, and terms based on the lender’s guidelines. This evaluation considers your income and credit information to determine your eligibility.

The biggest advantage of getting pre-approved is knowing exactly how much you can afford. This helps you focus your home search on properties within your price range, saving time and ensuring you look at homes that fit your budget.

Why do you require documents?

We require documents to verify the information provided in your application. These third-party records confirm your job history, current income, and assets, ensuring accuracy in the pre-approval process.

While not all lenders require documentation upfront, our team prioritizes providing reliable and accurate pre-approvals. When we say you’re pre-approved, you can trust that you’re on solid ground to close your home loan once you find the perfect home.

Why do I have to pay for my credit report?

Your credit report is essential for the pre-approval process, as it helps us assess your current debts—one of the key factors in determining how much you can borrow.

By paying for the report, you’ll receive a copy to review for accuracy and see your credit score. The good news? We’ll credit you back the cost of the report when your loan closes!

Do I need a Realtor while house shopping?

Buying a home is a major financial decision, and having a skilled Realtor can make all the difference. They guide you through the process—finding the right home, making a competitive offer, handling negotiations, and reviewing key documents.

With their market expertise, Realtors help you avoid costly mistakes and ensure a smoother, more informed buying experience.

Do I need a home inspection?

While an appraisal helps determine a home’s value, a home inspection gives you a detailed look at its condition. An inspection can uncover potential or existing issues before you commit to the purchase, helping you make an informed decision.

A professional home inspector will evaluate the property’s systems and components, identifying any necessary repairs and estimating their costs. While not always required, a home inspection provides peace of mind and can help you avoid costly surprises down the road.

My Branch

Where can you find me? At Advantage Mortgage’s Canby branch!

Let’s get started.

I’m excited for the opportunity to work together. How can I help you?